FOR PRIVATE CUSTOMERS

Benefit from our expertise in the key areas of effective asset protection, wealth accumulation and sustainable estate planning.

Private customers

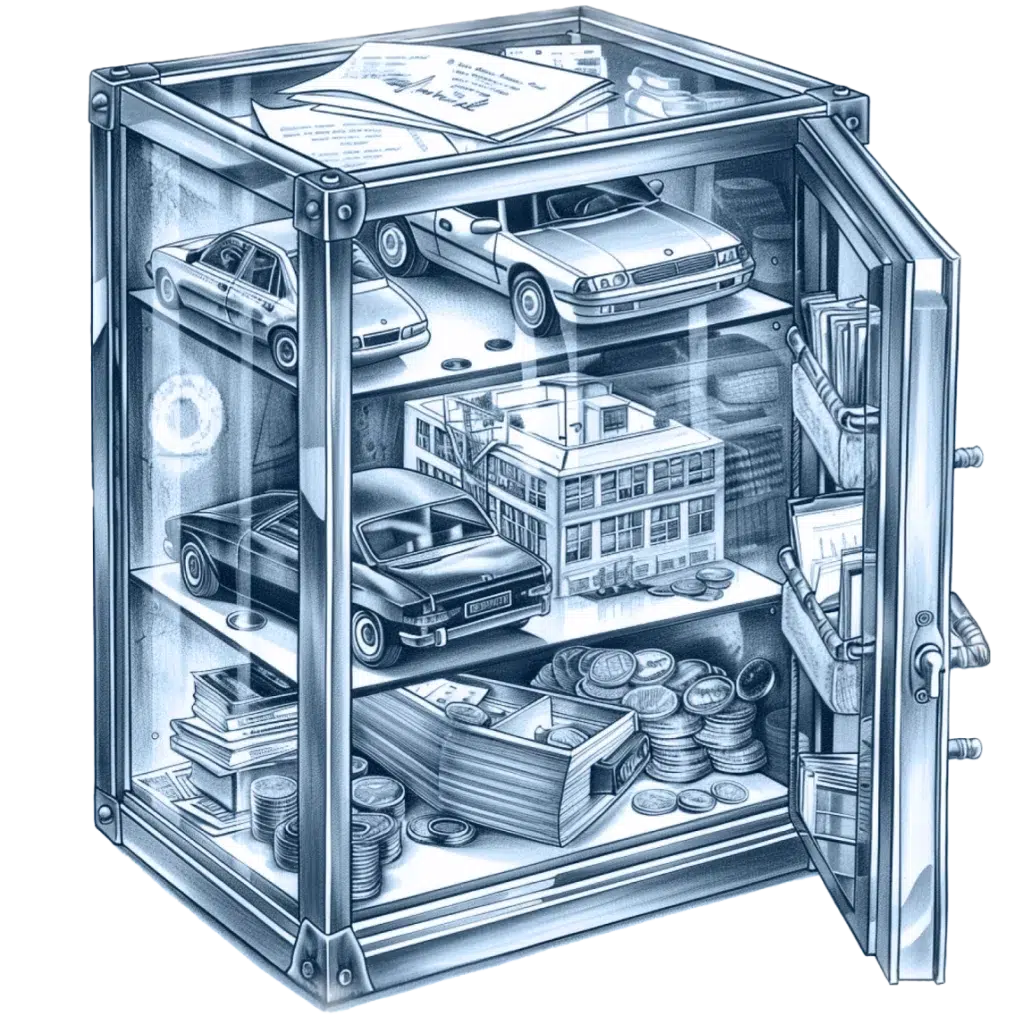

Asset protection not only means the certainty of knowing that your life's work is safe, but also that you are laying the foundations for your future and that of your family.

Especially in these times of uncertainty and change, the legally secure protection of your assets and their preservation over generations is more important than ever.

Your assets are exposed to a variety of dangers and threats. These potential risks are diverse in nature; from economic instability and political arbitrariness to corporate liability risks or even family discrepancies.

Targeted asset structuring effectively minimizes or even eliminates these risks to your assets. This forms the foundation for long-term asset protection and preservation of your assets. Here, you use preventive corporate law structures to protect your assets in the best possible way.

Efficient asset segregation by transferring your assets to specific legal structures - for example a German or Liechtenstein foundation or cooperative, but also Liechtenstein life insurance - protects assets in the best possible way. In this way, they are not only secured in the long term, but also organized and held for a specific purpose in your interests and according to your specific requirements.

With the help of targeted asset structuring, it is possible for both private individuals and entrepreneurs to increase their assets in a tax-optimized manner. As their personal tax burden is minimized and their assets grow more efficiently.

This gives you the opportunity not only to lay the foundations for your financial future and that of your family, but also to secure your assets in the face of global change. Future generations will thank you for this foresight.

Precautionary estate planning is crucial for ensuring the stability of your family and your assets.

Estate planning must therefore be approached with care and caution. Accordingly, it is necessary to deal with this sensitive issue within the family at an early stage in order to ensure that harmony within the family is maintained beyond the end of one's own life.

Holistic service

Our services include the integration and restructuring of assets in corporate structures.

We help you to protect your assets in a targeted manner, set them up in the best possible way for your estate and structure them in a tax-optimized way for your future life planning. Our advisory services focus on the complexity of your current circumstances and the uniqueness of your needs.

The focus of our individual advisory service is on developing a concept based on your specific circumstances and wealth planning with the premise of tailor-made implementation.

The foundation and starting point for our expertise is a thorough analysis of your current financial and life situation as well as your future plans. Only if all aspects are examined and considered in this regard can a comprehensive concept be developed.

When developing the solution concept, independence and objectivity are of central importance to us, so that the available options are determined in compliance with the legal requirements and your maximum added value.

We use German and Liechtenstein foundations as well as cooperatives, Liechtenstein life insurance and trusts, taking into account your individual needs, so that we can show you the best possible asset structuring and implement it together with you and our network of experts.

Thanks to our transparent and personal consulting approach and close cooperation with you, we ensure that you are always fully informed and up to date with your structural development. This enables us to present new and complex issues to you in a very tangible and understandable way.

FAQ

Get an insight into frequently asked questions about our services.

Find out more about our services and how we can help you,

to pursue your financial interests.

Individuality: We provide you with individual and customized advice based on your motives and goals.

Clarity and closeness: Thanks to our transparent and personalized consulting approach and close cooperation with you, we ensure that you are always fully informed and up to date with the latest developments. We strive to present complex issues as simply and comprehensibly as possible.

Holistic: We advise you at the interface of family, company and assets, design simple and comprehensible structures for effective handling of your concerns and rely on cooperation and a premium network to offer you the best possible solutions.

Especially in this decade characterized by uncertainty and change, the legally secure protection of assets and their preservation for future generations is more acute than ever. Dangers and risks to your assets can be effectively minimized through targeted asset structuring. Precautionary management of your assets offers you the opportunity to take preventive measures not only to effectively protect your assets, but also to increase them.

Assets are exposed to a variety of risks, some of which are very specific:

Each structure offers different advantages depending on its design. Our strength lies in identifying the most suitable structure for you from the wealth of possibilities and designing it in detail. We utilize the advantages of German and Liechtenstein foundations as well as cooperatives, among others - but also Liechtenstein life insurance companies. In addition to national solutions, we are also happy to show you international solutions that we can implement together with you and our network of experts.

We see ourselves as a partner at your side, supporting you every step of the way and helping you to achieve long-term financial security and prosperity. It is important to us that you are fully informed and understand the steps we are taking together to achieve your goals. Therefore, we are in regular contact with you to discuss developments and ensure that our strategy meets your current needs.

In the context of European competition, not only tax aspects are decisive for the choice of legal entity, but also corporate law aspects. Your long-term goals are at the forefront of the individual choice of legal entity. The options must therefore be determined objectively.